The switch from coal to oil had primarily been driven by the huge value provided by both the additional energy-density of oil and by the storage and transportation benefits of liquid fuels. Unspoken though, was the assumption that oil reserves would – for all practical purposes – be infinite. If one oil field ran dry, geologists would find another while engineers provided the means to extract it.

This appeared to be the story of the 1970s too. Yes, the economies of the developed states took an inflationary hit. But the increased cost of oil paved the way for new deposits in Alaska, the North Sea and the Gulf of Mexico to be opened up. And while prices never quite fell back to their pre-1970s level, they fell sufficiently by the mid-1980s to allow a new round of economic expansion to begin.

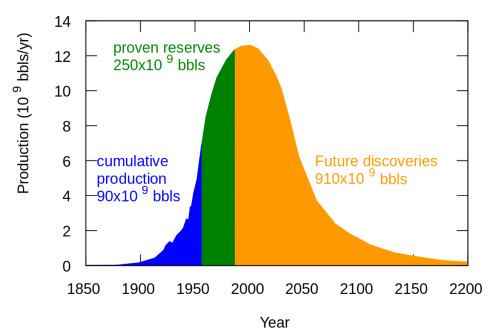

In 1956, though, a geologist working for the Shell oil company published a report which showed, among other things, that the process of discovering, drilling and extracting an oil deposit took approximately four decades. It followed that if we calculate the point at which the maximum quantity of oil within a country is discovered, then we can expect that its rate of extraction will begin to decline four decades later. This, he argued, was a particular problem for the USA, whose peak of oil discovery was in 1930. This suggested that the USA’s production peak would be reached sometime around 1970.

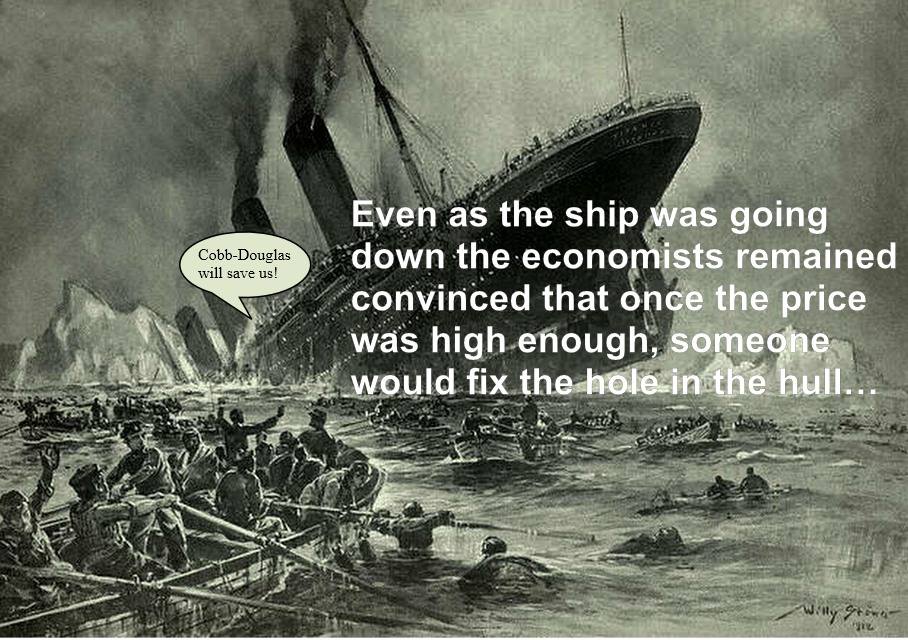

Although in 1970 the media mocked the prediction, this is precisely what happened; and it precipitated the oil shocks of the 1970s. But what happened is not what the proponents of “peak oil theory” said would happen. In large part, this is because the early peak oilers were geologists and engineers. And like so many modern scientists, once they had discovered that economists are – with a few notable exceptions – complete imbeciles, they wrongly concluded that the economy doesn’t matter… or at least, that the economy would simply adjust to the new situation.

The geology of US oil might have been straightforward; the economics was a little trickier. In the course of the Second World War, the USA supplied six out of every seven barrels of oil consumed. Venezuela accounted for most of the seventh barrel; with small contributions from British Persia and the Soviet Caucasus. Germany’s oil sources had been inadequate to power its civilian economy; and its failure to capture and bring online the Caucasus oil in 1942 is the primary reason why it lost the war.

The war-torn economies which emerged from the ashes of war in 1945, then, were almost entirely dependent upon oil from the USA. And this allowed an internal American oil cartel – the Texas Railroad Commission – to extend its price fixing to the entire world. So long as US oil made up a large part of global oil production, and so long as US oil fields had excess capacity, the TRC could regulate the global oil price. If prices began to rise too high, the TRC would order companies to produce more oil. If prices sank too low, the TRC would order production cuts. As a result, throughout the boom years 1953 to 1973, the world oil price remained stable at around $25 per barrel (at today’s prices).

When the US conventional oil fields peaked in 1970, the TRC lost its ability to prevent prices from rising by expanding production. This was a boon for Middle East and North African producers whose production costs were higher than those in the USA. And although the first – 1973 – oil shock was in part a response to western support for Israel in the Arab-Israeli war, sooner or later the newly empowered OPEC was going to cut supply to drive up prices.

It is an irony that a capitalist system which claims to be built upon competition and free markets has proved stable only in those periods when its source of value – energy – has been controlled by cartels. Once OPEC-led price stability was regained in the mid-1980s, the stage was set for the global debt-boom of the 1990s and early 2000s. And with the fall of the Soviet Union and the apparent conversion of China to state capitalism, for a brief moment the world seemed content.

Peak oil had not, though, gone away; it had merely been postponed. Britain discovered this the hard way after its North Sea deposits – which had once produced more oil than Kuwait – peaked in 1999. By 2005 – the year global conventional oil extraction peaked – Britain had become a net importer of oil and gas. Today, Britain’s North Sea deposits produce 60 percent less oil than in 1999; and the projected price of the remaining oil is not enough to cover the decommissioning costs.

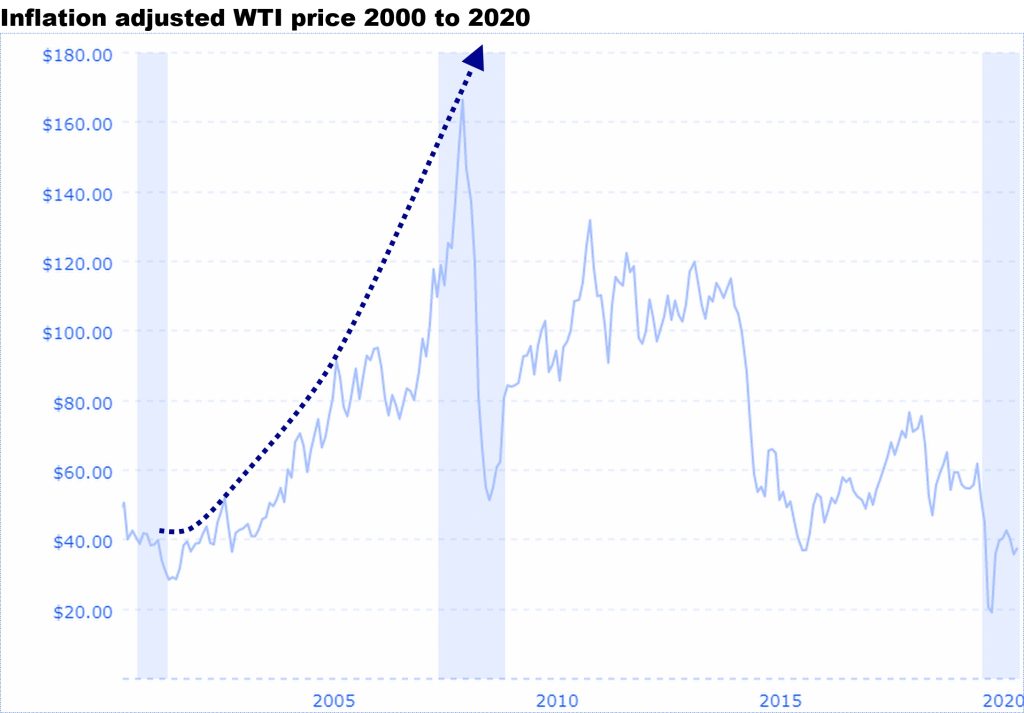

By 2005 though, had we but known it at the time, we had bigger problems to deal with. The experience of the oil shocks of the 1970s convinced many peak oilers that once the peak of global oil extraction had been reached, prices would rise remorselessly as a consequence of supply and demand imbalance. This, indeed, is what appeared to happen after the 2005 peak was reached:

By 2012, Michael Kumhof and Dirk V Muir from the International Monetary Fund were anticipating global oil prices of more than $200 per barrel by 2020. But that isn’t what happened. Instead, from 2014 the oil price slumped and has been on a steadily downward trend ever since. The reason is because there is more to peak oil than geology and engineering.

Indeed, many peak oilers make the same mistake as economists in treating oil – and energy in general – as being just another relatively low-cost factor of production. The wage bill, for example, is always far higher than the energy costs of running a business. But as economist Steve Keen explains; “capital without energy is a statue, labour without energy is a corpse.” Or as engineering professor Jean-Marc Jancovici explains: “energy is what quantifies change.” Nothing happens in the world without energy. And when the cost of the world’s biggest primary energy source – oil – begins to spike upward, the impacts are felt in every area of our lives.

The story of the 2008 crash is usually told in financial terms; and is used to blame the victims. The cause of the crisis, we are told, was so-called sub-prime borrowers taking on mortgages that they couldn’t possibly pay back. Except, of course, prior to 2008 they had been paying them back. So what happened to change their circumstances so that they could no longer repay debts? The answer is interest rate rises. The banks had based their lending on the assumption that the economy was stable; that inflation would grow at around two percent; and that interest rates would remain relatively low. With house prices supposedly guaranteed to keep rising, and having securitised the risks, banks – with the assistance of governments – could extend home ownership to the masses. But from 2006, central banks had been raising interest rates; tipping borrowers into default.

Why had the central banks been raising interest rates? Because from 2005, inflation began to break out of the 1 to 3 percent band that they were charged with maintaining. According to all of the textbooks they had been brought up on, the central bankers had been taught that the way to bring inflation back under control was to raise interest rates. But they – and the economics textbooks – were wrong. What they believed to be inflation – too much currency chasing too few goods – was actually an economy adjusting to its first supply-side shock since the 1970s.

This is not an obvious distinction, because to most ordinary people the result of both demand-side and supply-side shocks is the same; rising prices. But the cause of a demand-side shock is merely that too much currency is circulating (or is flowing at the wrong velocity) to remain in balance with the real economy. Most often when governments and banks create more currency than there is economic activity to absorb it. In such circumstances, consumers seek to spend the excess currency and cause prices to rise. By raising interest rates, the currency supply can be cut and prices brought down. In a supply-side shock, in contrast, the stock of currency remains stable while some factor of production runs short; forcing up the price of everything that depends upon it. When this occurs, raising interest rates cannot solve the problem because the shortage persists irrespective of how much currency is in circulation.

The 2005 supply side shock was particularly profound because it impacted our primary energy source – oil. Look around your home and you will be hard pressed to find a single thing which was not made from oil; constructed using machinery powered with oil; or transported on vehicles that run on oil. The same is true for every household and business in the developed world. So that when the price of oil increases so, too, does the price of everything else. And the solution to it is not to raise interest rates, but to let the economy adjust to the new conditions. As Frank Shostak from the Mises Institute explains:

“If the price of oil goes up and if people continue to use the same amount of oil as before then this means that people are now forced to allocate more money for oil. If people’s money stock remains unchanged then this means that less money is available for other goods and services, all other things being equal. This of course implies that the average price of other goods and services must come off.

“Note that the overall money spent on goods does not change. Only the composition of spending has altered here, with more on oil and less on other goods. Hence, the average price of goods or money per unit of good remains unchanged.”

In putting up interest rates in the face of a supply-side shock that they did not understand, the central bankers set off the chain of events that caused the entire global banking and financial system to unravel. The correct – but painful – play would have been to allow the peak oil shock to work its way through the economy. The result would have been a dramatic shift away from discretionary consumption as businesses and households were obliged to spend more on essentials like food, utilities, housing/rental and, of course, energy. After all, that is where we eventually ended up… only with the added cost of bailing out and more or less permanently having to underwrite the financial system.

Globally, what anaemic economic growth there was in the aftermath of the crash was the result of massive – and ultimately unsustainable – debt. As Tim Morgan explains:

“Over the period between 1999 and 2019, World economic output … averaged 3.2%, for a total increase of 95%, or $64.5 trillion. During this same period, however, annual borrowing, expressed as a percentage of GDP, averaged 9.6%, with total debt expanding by $193tn, or 177%, between 1999 ($109tn) and 2019 ($302tn).

“Another way of putting this is that each dollar of reported ‘growth’ was accompanied by $3 of net new debt. Even this comparison understates the gravity of the situation, in that it does not include huge increases in pension and other commitments over two decades, with the overall situation worsening markedly after the 2008 global financial crisis (GFC).”

In the UK, the average wage (not including bonuses) was the same in 2019 as it had been in 2010. Over the same period, household spending has shifted dramatically toward non-discretionary items; fuelling the retail apocalypse that was already decimating retailing prior to the arrival of SARS-CoV-2. The impact though, was experienced differently according to class and location. The UK contains both the richest and nine of the ten poorest regions in Northern Europe:

The metropolitan middle classes living in London and the archipelago of top-tier university towns continued to enjoy rising prosperity throughout the period. Meanwhile, large swathes of ex-industrial, rundown seaside and small town rural Britain experienced declining standards of living. But since the establishment media, the permanent government and the various lobby groups are staffed by the metropolitan middle classes, little thought was given to the needs of the majority whose living standards and future prospects were being crushed. This, more than any other reason, is why Brexit happened in 2016.

The other key distortion which followed from the central bank response to the 2008 crash is that investment income plummeted. Prior to peak conventional oil, interest rates were running at around 4.5%. In response to the oil shock they rose above 6%. But after the crash they fell to less than 1%. And despite periodic reassurances that rates would be going up soon, only the US Federal reserve ever did raise rates; and the impact was so bad that they very quickly cut them again.

Historically low interest rates have unquestionably kept millions of “zombie” businesses and households on life support. At the same time, they have crushed the incomes of institutional investors like pension and insurance funds which need returns above 5% (and some more than 8%) to meet their obligations. An unforeseen consequence of this is that the years after 2008 saw a “search for yield” in which investors became far more amenable to purchasing so-called “junk bonds.” And one industry which reaped the benefit of this trend was US hydraulic fracturing.

Unconventional – i.e. expensive and difficult – oil from the US shale plays and Canadian and Venezuelan bitumen sands was only economically viable because investors were prepared to spend billions of dollars producing millions of dollars’ worth of oil and gas. But although it was economically unviable in the long-term, in the course of the last decade it drove global oil extraction to new highs.

The myth of “Saudi America” and the “century of energy independence” was born. But more sober analysts pointed out that fracking wells have a nasty habit of depleting by 90 percent in just three years. This dictated a kind of “red queen syndrome” in which the frackers have to drill more and more wells just to keep the oil flowing. Far from a century of oil and gas, the frackers would be lucky to continue for more than a decade.

But for all of the irrationality behind fracking, it effectively silenced concerns about peak oil. The very existence of fracking and tar sands seemed to confirm the economists’ myth of infinite substitutability – that whenever a resource runs out, price increases will lead to an alternative being developed:

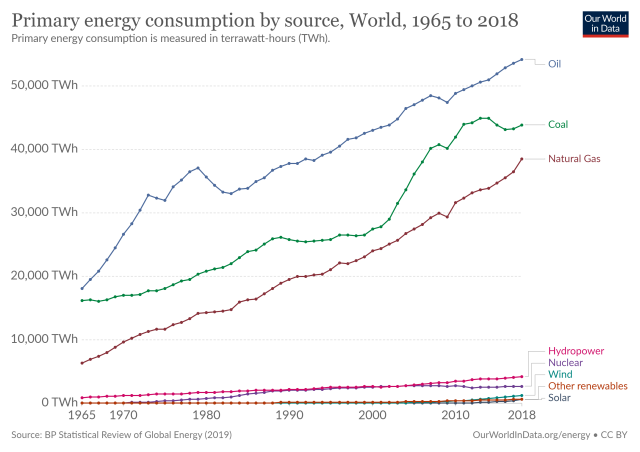

For most of the last decade, we have been sold a techno-utopian fairy tale about “peak oil demand.” Instead of “running out” of oil, the problem for the oil industry, we were told, was that the switch to “clean energy” and to technologies like electric cars and hydrogen-powered buses meant that demand for oil was declining. Within a decade or so, they claimed, our need for oil would disappear entirely as we ushered in a “fourth industrial revolution” based around digital products and services powered by renewable energy.

As with all narratives, there is just enough truth in this story to give it a veneer of credibility. Per capita demand for oil – and, indeed, for fossil fuels generally – has been declining. So that is you are a middle class metropolitan liberal – the kind of people who edit and write for the establishment media – you look around and notice your friends driving electric cars; you uncritically swallow the press statements of the windfarm owners; and you observe the declining per capita consumption of oil; and you tell yourself that this is peak oil demand in action.

The data says something very different:

Despite a Herculean effort to bring non-renewable renewable energy-harvesting technologies online, they still account for less than five percent of global primary energy consumption. Worse still, they have not replaced fossil fuels; they have just been added to the global mix. And while developed states like Germany and the UK have gone a long way toward decarbonising their domestic electricity generation, a large part of their true pollution has been offshored to Asia. Only if they are prepared to forego all of the fossil-fuel powered goods they import can they truly claim to be embarking upon a new industrial revolution. Until then, the “green new deal” is just another name for the same old imperialism that they have always practiced.

Peak oil – including from fracking and tar sands – finally occurred in 2018. Hardly anyone noticed because – as happened in the USA in 1970 – everyone assumed that it would be a temporary blip. Oil extraction in 2019 was not substantially lower than 2018; but there was no month in 2019 when extraction was higher than it had been in November 2018. And, of course, in 2020 the world discovered more urgent issues to worry about. Nevertheless, oil extraction – and oil demand – plummeted as a result of the various state responses to the pandemic. Some wells will be shut permanently as the cost of reopening them is too high. Others will reopen, but only if the price of oil rises considerably. Pipelines and refineries will also have to be repaired. On the demand side, even the most optimistic economists and politicians have ceased talking about “V-shaped recoveries.” With Europe and parts of the USA embarking on pre-Christmas lockdowns, demand across the global economy is expected to be crushed. This spells lower rather than higher oil prices in the next couple of years.

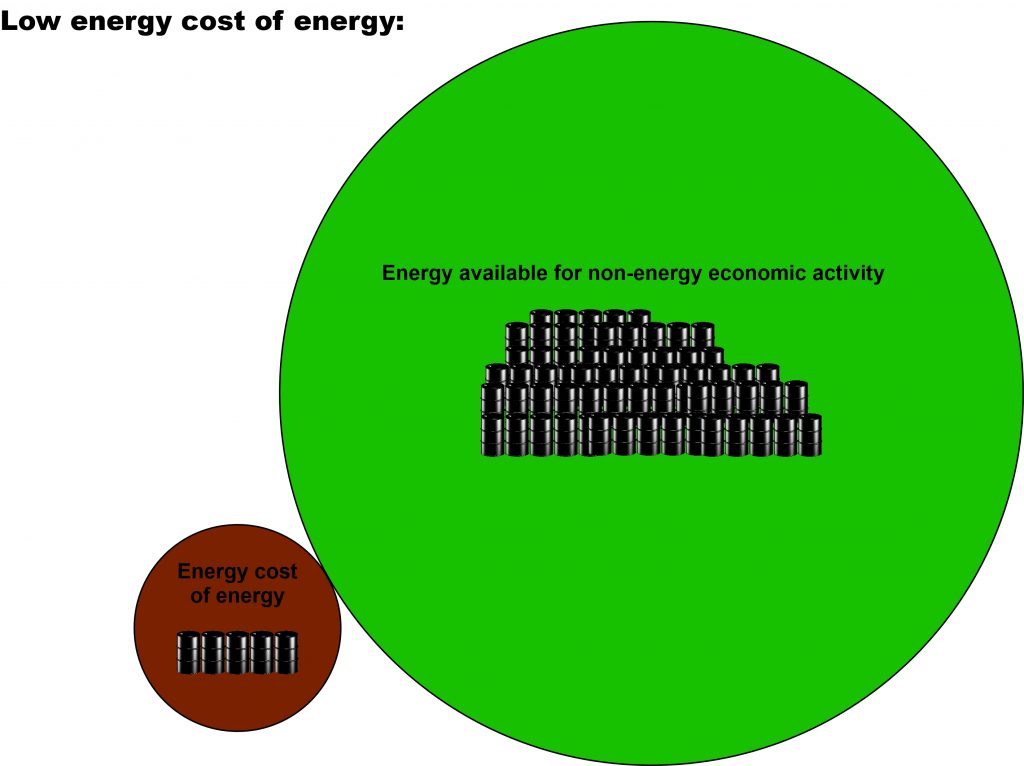

It is in this that we glimpse the part of the peak oil story that was often overlooked by the first peak oilers. The simple assumption that falling oil production would lead to higher oil prices failed to examine the impact of oil prices on the wider economy. Nevertheless, the economy is primarily an energy system upon which the secondary financial economy is merely a claim. Rather than examining the price of oil, we have to understand its energy cost. If we begin with a certain amount of energy, then a fraction must be devoted to securing future energy. Another fraction must be set aside for maintaining the infrastructure required to keep the system running. A third fraction must be set aside to invest in the future energy supply. These, though, will only account for a small part of the energy available to us. The remainder will power the much larger, non-energy economy; comprising almost all of the goods and services we consume:

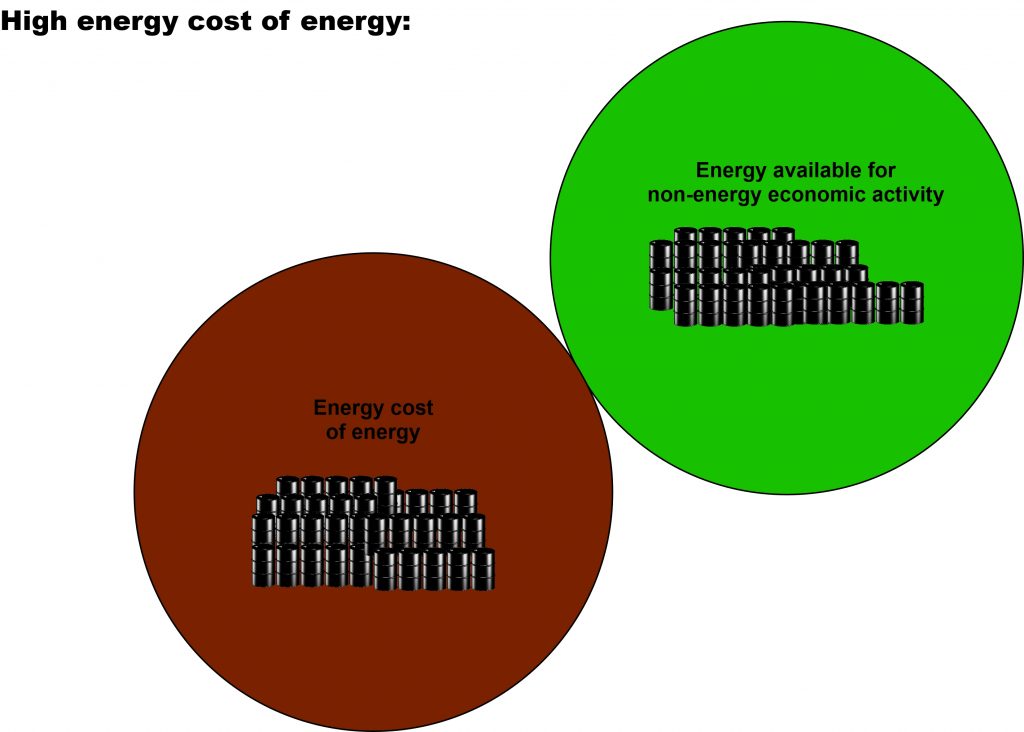

If, then, the energy cost of energy increases – i.e. we have to divert more energy away from the non-energy economy; the non-energy economy must shrink:

This has a dramatic impact on the living standards of the majority of the population. On the one side, their income is squeezed as the non-energy sectors of the economy struggle to remain profitable. On the other, the rising cost of energy-intensive non-discretionary goods and services (housing, transport, utilities, food, etc.) forces them to curb their consumption.

As Gail Tverberg has warned many times, it is consumption rather than production which drives the post-peak oil economy. That is, although the oil industry needs higher prices to remain profitable, it is consumers’ collective lack of purchasing power which forces prices down. Temporary increased prices – such as those immediately after the 2008 crash – are unaffordable. As consumers have to pay more for essentials, they cut spending on discretionary items; driving the retail apocalypse and forcing manufacturers to cut production… thereby lowering demand for oil. Thus oil prices are forced down to a level consumers can afford:

While, from a metropolitan liberal perspective, this decline in demand for oil may look like a good thing, it actually points to a major unravelling of the global economy in the near future as much of the non-energy economy that we have constructed since the Second World War can no longer be sustained.

In his recent presentation, Simon Michaux from the Finnish Geological Survey highlights the downward trend in oil prices since the 2008 crash:

Another way of viewing this is that all of the central bank efforts at quantitative easing and ever lower interest rates have failed to resolve the consequences of peak oil. Not enough people have been left with disposable income (after the bills have been paid) to consume sufficiently to raise the price of oil to a point where the industry can remain profitable.

Ironically, one of the oil industry’s response to this problem has been to go “green.” Energy companies are using non-renewable renewable energy-harvesting technologies to lower the energy cost of their operations in a final attempt to lower the oil price at which they can be profitable. But even this can only be a short term solution if the discretionary spending power of the wider economy continues to decline. Perhaps the more sobering interpretation of the post-2008 trends is that when those two trend lines meet, industrial civilisation is over.

For the moment, however, the continuing slump in oil prices will be treated by economists, politicians and establishment media journalists as proof that the transition from fossil fuels to renewable energy is gathering pace. As a result, instead of making serious attempts to mitigate the damage that severe energy shortages will cause, they will continue to push the narrative that their mythical fourth industrial revolution is well under way.

Yes, humanity will eventually revert to “green energy,” but not in the way techno-utopian fantasists imagine. Rather, as the energetic basis of the industrial economy collapses, those who survive will mainly be left with energy technologies like water wheels, windmills and sails to supplement human and animal labour power at an economic level not dissimilar, at best, to the early nineteenth century… that’s just what happens when you run out of gas!

Author

Tim Watkins, residing in the UK, is a social and economic scientist with a background in public policy research.

![]() Don't forget to feed the birds. Every bread crumb helps! Donate here

Don't forget to feed the birds. Every bread crumb helps! Donate here