We're told inflation is transitory (you mean like terminal cancer is "transitory"?), the economy is opening up and growing smartly.

None of this is remotely persuasive. OK, we get it: the pandemic shutdown crushed supply chains and demand, and then trillions of dollars, yen, yuan and euros of monetary and fiscal stimulus boosted pent-up demand which then snarled creaky supply chains. Inflation is transitory because the effects of this massive stimulus is temporary and the global supply snarls will all be unkinked shortly.

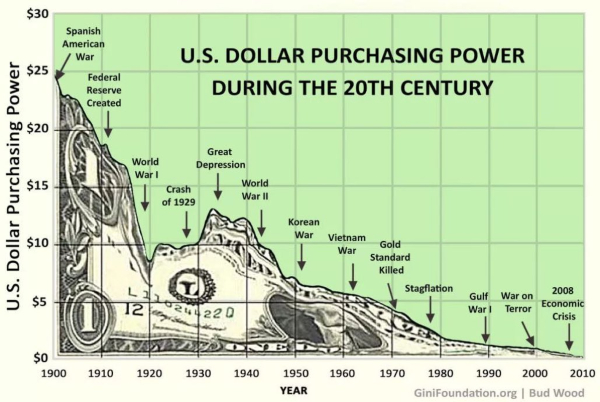

But this happy story only accounts for a thin wafer of global supply issues. Yes, a few items may be restored to low-cost production and shipping, but all this rah-rah ignores the primary dynamics: all the cheap, easy-to-get resources have been extracted and consumed, and labor costs, crushed for the past 45 years, have reversed: after being stripmined by capital for the past 45 years, labor is now demanding some modest restoration of decades of diminished purchasing power, not just in the U.S. but in China and other production nodes in global supply chains.

Capital's screams of agony are laughable, as the top tier of capital has added trillions in wealth at the expense of the bottom 99.5%. The wealth of the few has metastasized into hyper-wealth--$100 million yachts and villas barely scratch the surface of the billions gained by gaming financialization and the Federal Reserve's financial fentanyl.

Although nobody benefiting from the Fed's financial fentanyl seems to have noticed, hyper-wealth has extinguished democracy and destabilized the economy and society. With trillions gushing into the wealthiest families and corporate insiders, "democracy" has been reduced to an invitation-only auction of political favors.

If you didn't get your desired favors, then increase your bid. Big Pharma, the "defense" (heh) industry, Higher Education, Big Ag, Big Tech, et al. are all willing to pony up millions in bribes--oops, I mean "donations"-- to multi-millionaire politicos profiting from insider trading (cough, Pelosi, cough). Revolving doors ensure the right people get fat speaking fees, cushy do-nothing slots in philanthro-capitalist foundations, etc.

The decay caused by hyper-wealth is systemic: the moral decay of a thoroughly corrupted "leadership," a sham facade of "democracy" (vote for whomever you want, the ownership of power doesn't change), an economy dominated by profiteering cartels and quasi-monopolies, a class system in which privilege is hidden in plain sight, a society of haves who have broken the rungs of the social-mobility ladder, leaving the have-nots unaffordable housing, unaffordable higher education, unaffordable healthcare, unaffordable childcare, etc., all to be paid out of wages that have lost purchasing power for decades and continue to lose ground as "transitory" inflation is embedded in essentials and fripperies alike.

Meanwhile, back in the wintry real world, everyone facing a dime in higher costs is jacking up their price by a dollar. "Inflation" is a handy cover for jacking up prices just to see how much the panic-hoarding, desperate consumer will pay: hmm, a used truck costs more than a new truck cost two years ago? I'll take it! A mattress-in-a-box has doubled in price? I'll take it! A fast-food burger is now 50% more? Give me four, and charge it to my credit card.

Oh, but wait--everything is being fixed by speculative bubbles that enrich everyone who bought assets long ago. That's obviously a solution that benefits everyone, right? So the newly enriched can buy overvalued assets from other newly enriched, all funded by the Fed's financial fentanyl.

Yes, it's time to distribute victorious wreaths to the purveyors and profiteers of financial fentanyl. Hubris is ascendent just before the fall.

Now are our brows bound with victorious wreaths;

Our bruised arms hung up for monuments;

Our stern alarums changed to merry meetings,

Our dreadful marches to delightful measures.

Author

Charles Hugh Smith is a contributing editor to PeakProsperity.com and the proprietor of the popular blog OfTwoMinds.com. He is the author of numerous books, including Why Everything Is Falling Apart: An Unconventional Guide To Investing In Troubled Times.

![]() Please help keep us afloat. Donate here

Please help keep us afloat. Donate here