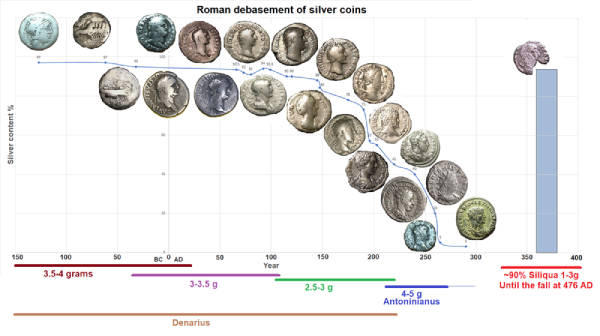

From 200-300 Rome was hit with massive inflation. It sounds laughable today, but a yearly 5% inflation rate quickly compounds into ruin. Over 100 years, the Roman currency devalued by 99.5%. This is how exponential growth works, it drives you into bankruptcy just as Ernest Hemingway said, “gradually, then suddenly.” A bum sponge that once cost 0.5 denarii 'suddenly' cost 100. The Roman rulers were up shit creek without a paddle.

As Cornell and Matthews wrote in 1982's The Roman World,

The later 3rd century saw a momentous weakening of the monetary system. The causes of this were complex, one of them being the Roman authorities' own lack of comprehension of any theory of monetary circulation, and so of the economic consequences of their own actions.

The Romans didn't know what the fuck they were doing, but they had to do something. So the permanently warlike empire did the one thing they were good at. Class warfare. Rome's ruling Tetrarchs (great band name), issued reliable gold and silver coinage and let copper (which the masses used) inflate wildly. They protect the elite's asset class and kicked the peasants in the ass. Sound familiar? It's a tale as old as time. As the Roman General Antonio Soprano said, “this thing is a pyramid, since time immemorial. Shit runs downhill, money goes up. It’s that simple.”

As Cornell and Mathews said,

The Tetrarchs did not at once succeed in stopping inflation, but by a combination of methods they checked it and left a partially stable monetary system to their successors. This was achieved by a series of monetary reforms, the most important of which was the creation of a new gold coin, struck at a high standard of purity at a rate of 60 coins to the pound of gold bullion. With a devaluation of one-fifth by Constantine, this system formed the basis of the stable gold currency of Byzantium. There was also a standard of silver coinage, which held its value relatively well in relation to gold, and of copper, which did not. The result was continuing inflation in prices as expressed in copper coin, the everyday currency of the Empire's populations.

Thus Rome controlled inflation by bailing out the rich and drowning the poor, as is neoliberal (really neoclassical) policy today. For all their hand-waving, modern economist might as well be reading entrails. Modern economists can't predict recessions and don't even have a concept of the environment outside of their models. They're literally just making up reasons why the rich can just make up money, while the poor must eat austerity. As Leo Tolstoy said in 1900, “When people behave badly they always invent a philosophy of life which represents their bad actions to be not bad actions at all, but merely results of unalterable laws beyond their control.”

Modern economist are as clueless as Rome's proto-economists were. America's lead economic adviser, Jared Bernstein, cannot explain how the monetary system works. Just listen to him.

Bernstein: The US government can't go bankrupt because we can print our own money.Question: Like you said, they print the dollar, so why does the government even borrow?Bernstein: Well, the, um, so the I mean again some of this stuff gets, some of the language and concepts are just confusing. I mean, the government definitely prints money and it definitely lends that money, which is why the government definitely prints money and then it lends that money by selling bonds.Is that what they do? They, um, they yeah, they, um, they sell bonds, yeah, they sell bonds, right, because they sell bonds and people buy the bonds and lend them the money.Yeah. So a lot of times, a lot of times at least to my ear with MMT [Modern Monetary Theory], the language and the concepts can be kind of unnecessarily confusing, but there is no question that the government prints money and then it uses that money to, um, uh, uh, so, um, yeah, I, I guess I'm just, I can't really talk, I don't, I don't get it, I don't know what they're talking about. Like, because it's like, the government clearly prints money, it does it all the time, and it clearly borrows, otherwise we wouldn't be having this debt and deficit conversation, so I don't think there's anything confusing there.

This answer is of course confusing as hell. The chief economic adviser to the chief economy can't explain basic monetary policy, but they're fine conducting experiments on a live human population, many of whom their policies kill. Ruling economists are both asleep at the wheel and speeding. To recycle Cornell and Matthews, ‘The causes of this were complex, one of them being the [American] authorities' own lack of comprehension of any theory of monetary circulation, and so of the economic consequences of their own actions.’ It is, as my historical thesis goes, same shit, different day.

Today, an Empire still based on Roman Law and operating under Roman columns thinks it's reinventing the wheel with all its fancy models and big data. But it's just going in circles. When times get tough, debase whatever the poor people hold and preserve the rich. Today, investors get government bailouts and workers get public services cut. The stock market only goes up for asset holders, while costs only go up for the dumbasses on the ground. This phenomenon is, in fact, two sides of the same coin. One man's debt is another man's interest income. The rich people hold debt slaves as an asset in their portfolio. Every prole paying 30% on their credit card is earning 30% for someone else.

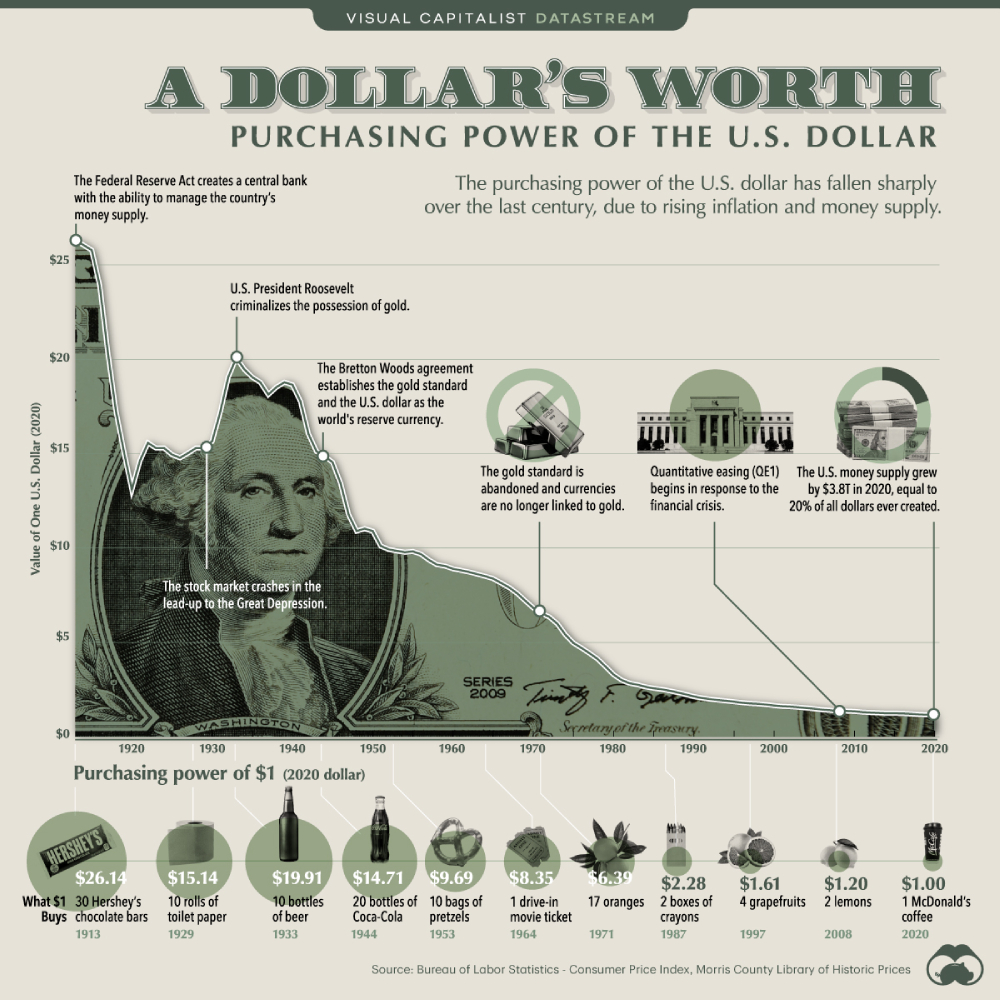

Image by the Visual Capitalist

The Roman Empire is very much the grandpappy of the American Empire (née European) and they're philosophical contiguous. They're all also facing the same problems. 10 rolls of toilet paper that cost a dollar in 1929 costs $15 now. The US dollar has, in fact, lost 98% of its value since just the 1970s. People say this is only if you don't count the interest, but most people don't earn interest. What these sanguine economists are describing is the phenomenon of the Empire bailing out the rich while the poor drown.

The White Empire under the US is having the same inflationary pressure as Rome but, in true American style, they've supersized the problem. 80% of all US dollars ever 'printed' were issued just during the reign of COVID the 19thever80% of all US dollars ever 'printed' were issued just during the reign of COVID the 19th, a hockey-stick span of just 22 months. At the same time, they're sanctioning 1/3rd of all nations (most of them unwitting vassals) and 60% of poor countries. They're both debasing their currency and disallowing people from using it.

As a 2023 report says, “Moneywise reported that the U.S. dollar has lost 98% of its purchasing power since 1971, but gold has maintained its value.” Sound familiar? Cash (ie, copper) has devalued rapidly, while US Treasuries are still gilt as gold. The investor class is protected by the Empire, while the working class is eviscerated. Then economist look through their entrails, and say that everything is great, actually.

Economists point to their charts of asset prices (ie gold and silver) to say that the economy is 'stable,' but ordinary people know that their copper coin can't buy toilet paper or food anymore, and nevermind education or housing. The real question is not what the government's monetary policy is but for whom. Empire will always bail itself out, and unless you're a Senator or banker's son, that's ain't you. As Creedence Clearwater Revival said, “Some folks are born silver spoon in hand, Lord, don't they help themselves, no. But when the taxman come to the door Lord, the house lookin' like a rummage sale, yeah.”

The fact is that we still live under an invisible White Empire today, so invisible that rich politicians play Fortunate Son at their rallies, without shame. We sit in literally segregated seats (economy and business) and pretend like we're equals. The only equalizing factor is that the plane is crashing. The economic stewards are serving one last round to the rich, while the poor can eat austerity. This is the same thing Rome did. Their monetary reforms only bought a little bit of time (and crime) before the fall. Rome, at least, only crashed Europe, which always deserves it. Today, the rapid inflation of the White Empire is burning the whole planet and the climate gods themselves are delivering a worldwide smackdown. Can't you smell what BlackRock is cooking?

Author

Indrajit Samarajiva is a Sri Lankan geopolitical analyst. The themes he generally writes about are collapse, because, in his own words: "I can both observe it and my country is generally ahead of the dismal curve, climate change (which I realize now is a symptom of the more general collapse), White Empire (what I call the American empire which has all the old colonizers as vassals), philosophy, politics, parenting, and whatever goes through my head." He can be reached at .