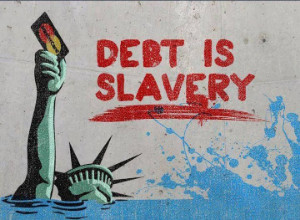

Image: CreativeResistance.org

The conventional definition of a Bear is someone who expects stocks to decline. For those of us who are bearish on fake fixes, that definition doesn’t apply: we aren’t making guesses about future market gyrations (rip-your-face-off rallies, dizziness-inducing drops, boring melt-ups, etc.). No, we’re focused on the impossibility of reforming or fixing a broken economic system.

Many observers confuse creative destruction with profoundly structural problems. The technocrat perspective views the creative disruption of existing business models by the digital-driven 4th Industrial Revolution as the core cause of rising income inequality, under-employment, the decline of low-skilled jobs, etc. — many of the problems that plague the current economy. Read More

Other posts by Charles Hugh Smith

The following reports from Max Keiser are excellent companions to Smith's essay, in particular his discussions with Dr. Michael Hudson:

Keiser Report: Canceling Debt to Avoid Economic Crisis

In this episode of the Keiser Report, Max and Stacy discuss David Graeber’s thought piece about the #GiletsJaunes and how the fact that intellectuals have failed to understand it proves we are living in revolutionary times. Graeber notes, as Keiser Report had only last month, that Cantillon effect has created the mass disparity in wealth against which those who must pay for this disparity are rising up.

In the second half, Max interviews Dr. Michael Hudson, author of the new book “… and forgive them their debts”, about the history of debt forgiveness. Hudson explains that the rulers of Byzantium wiped out the savings of rich people by forgiving debts because canceling debts does not cause economic crises but prevents them.

Keiser Report: Market Sell-Offs – Fake News or Bots to Blame?

In this episode of the Keiser Report, Max and Stacy discuss the collapse in Deutsche Bank’s share price and what that means for Europe going forward. They also look at headlines in which bankers are blaming stock market sell-offs on both ‘fake news’ and algorithmic trading.

In the second half, Max continues his interview with Dr. Michael Hudson, author of the new book “… and forgive them their debts” about the history of debt forgiveness. They discuss the rise of ‘populism’ and even ‘fascism’ in the face of unforgivable debts and look at modern debt forgiveness policy, the most major one being the write-down on Germany’s debts after World War II.