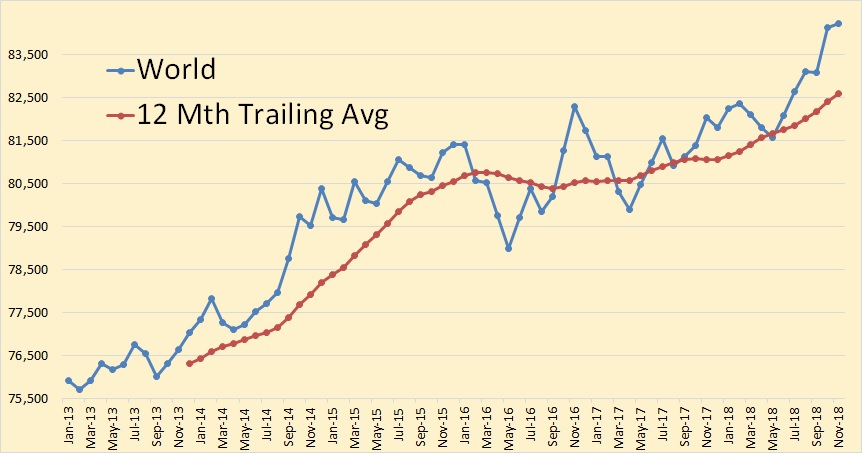

World C+C was up 96,000 bpd in November to 84,225,000 bpd.

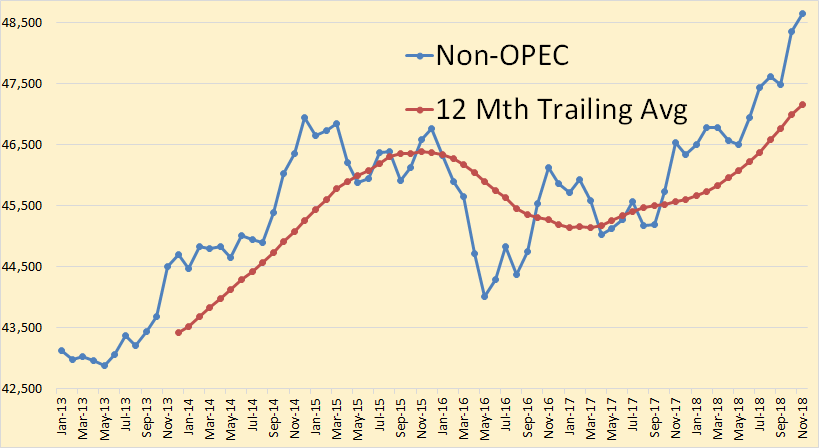

Non-OPEC was up 280,000 bpd in November to 48,638,000 bpd.

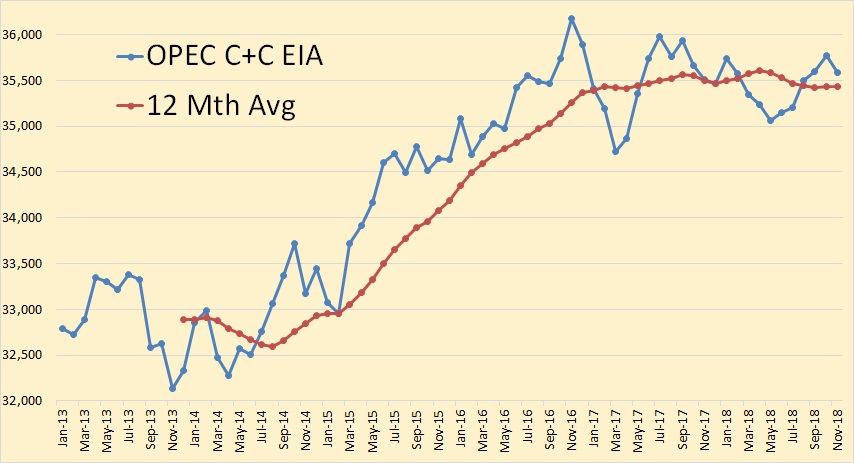

The EIA says OPEC C+C was down 184,000 bpd to 35,587,000 bpd in November.

The USA was, by far, the big gainer in November, up 345,000 bpd to 11,900,000 bpd.

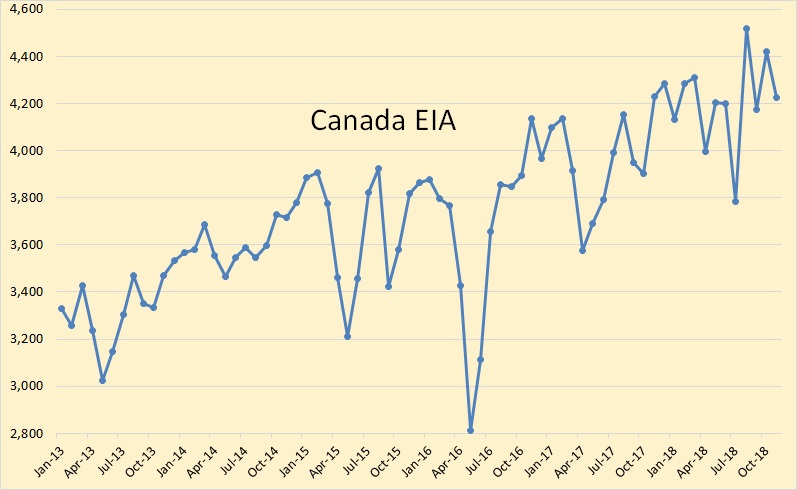

Canada was down 195,000 bpd to 4,295,000 bpd.

The EIA says Russia was down, in November, 42,000 bpd to 10,972,000 bpd.

China was down 10,000 bpd in November to 3,779,000 bpd.

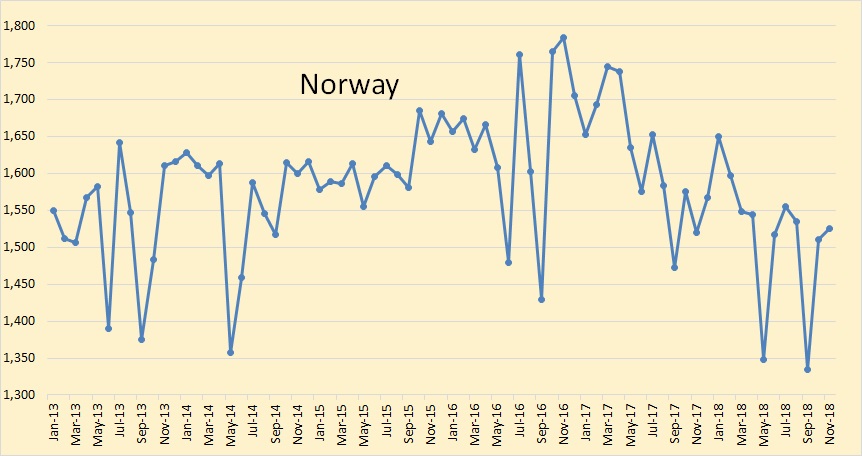

Norway was up 14,000 bpd to 1,525,000 bpd.

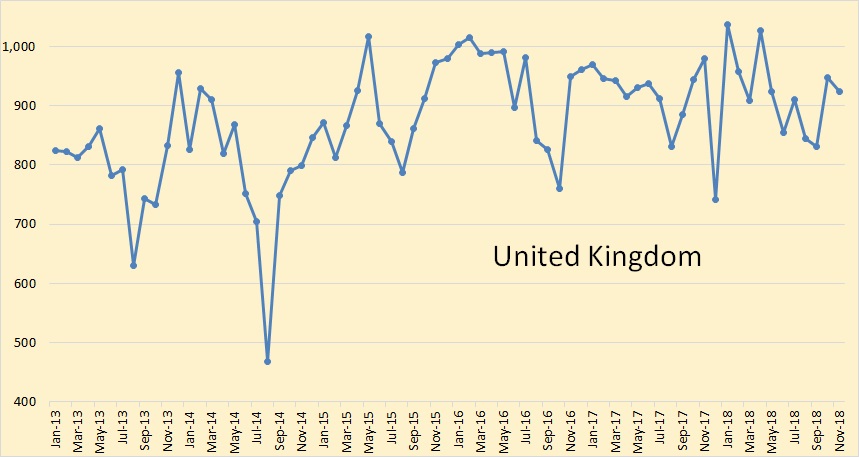

The United Kingdom was down 24,000 bpd to 924,000 bpd.

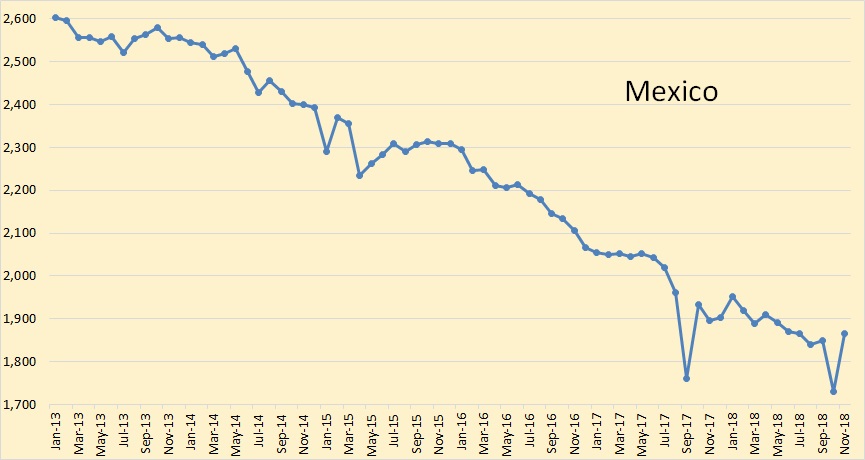

Mexican production was up 134,000 bpd to 1,865,000 bpd in November.

Egypt was up 5,000 bpd to 641,000 bpd in November.

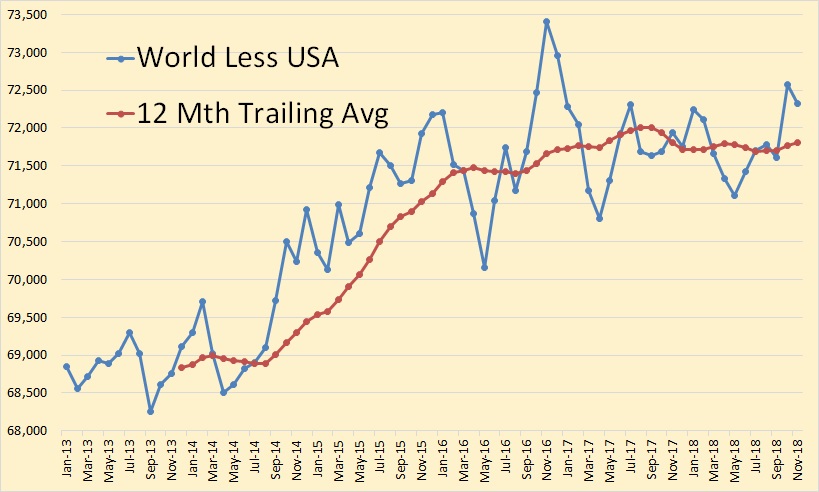

World C+C less USA production was down 249,000 bpd to 72,326,000 bpd in November.

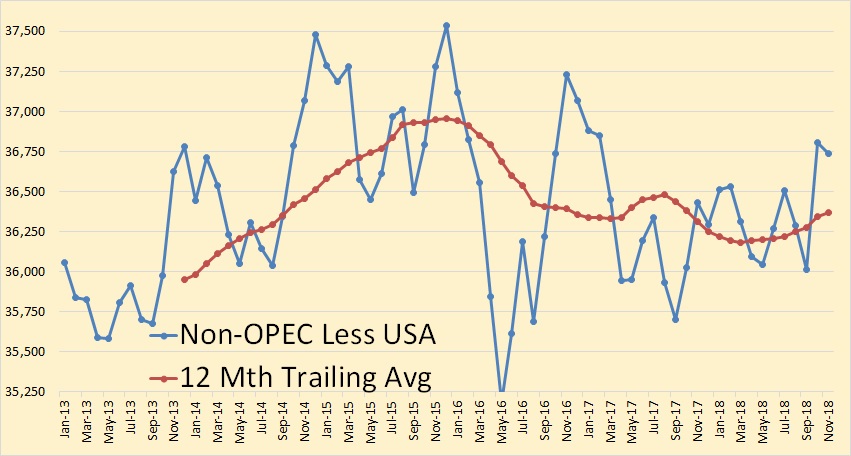

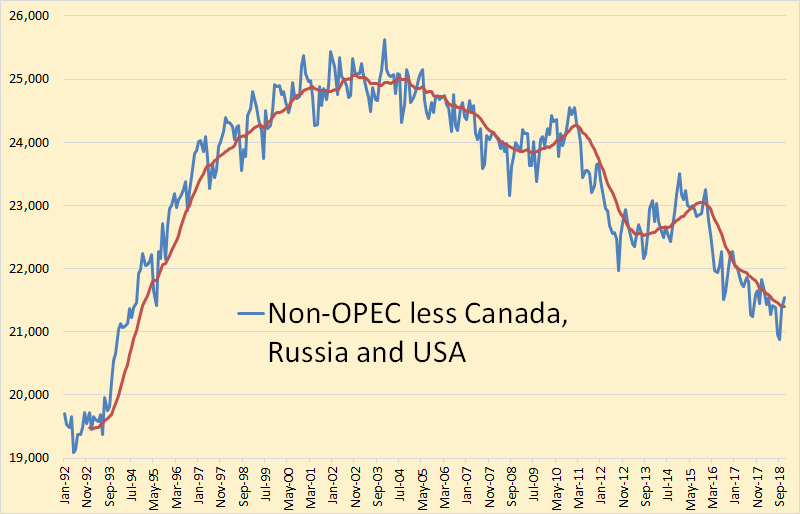

Non-OPEC less USA C+C production was down 65,000 bpd to 36,739,000 bpd in November.

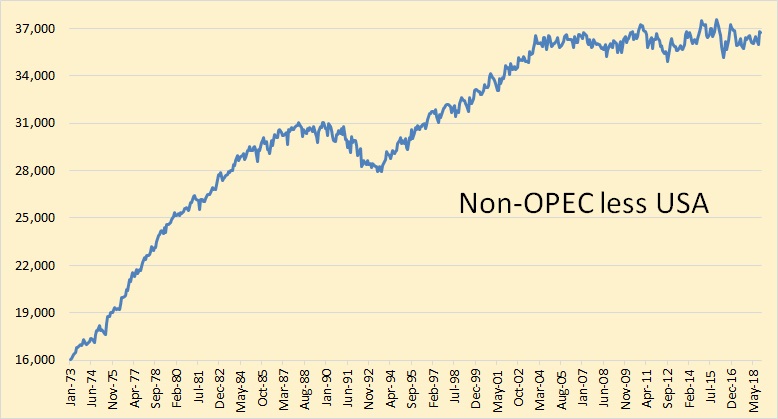

Non-OPEC less USA has been on a bumpy plateau for 15 years. It has been only Russia and Canada that has kept that bumpy plateau going for 15 years.

So it’s up to Canada, Russia and the USA to keep Non-OPEC from tanking. Canada is nearing maximum production due to pipeline constraints and even the optimistic oil experts are saying Russia is near her peak, so it is up to the USA to keep Non-OPEC peak oil at bay. And that means it’s all up to the shale oil patch to keep increasing production.

However….

Olson, Bradley; Elliott, Rebecca.Wall Street Journal (Online); New York, N.Y.

The once-powerful partnership between fracking companies and Wall Street is fraying as the industry struggles to attract investors after nearly a decade of losing money.

Frequent infusions of Wall Street capital have sustained the U.S. shale boom. But that largess is running out. New bond and equity deals have dwindled to the lowest level since 2007. Companies raised about $22 billion from equity and debt financing in 2018, less than half the total in 2016 and almost one-third of what they raised in 2012, according to Dealogic.

The loss of that lifeline is forcing shale companies—which have helped to turn the U.S. into an energy superpower— to reduce spending and face the prospect of slower growth . More than a dozen companies have announced spending reductions so far this year, even as crude-oil prices have rallied more than 20% from December lows. More are expected to tighten budgets as they release earnings in coming weeks.

The drop in financial backing is especially being felt by smaller, more indebted drillers. But even larger, better-capitalized frackers are facing renewed investor skepticism about whether they can keep spending in check and still hit growth and cash-flow targets.

Shares of Continental Resources Inc. fell 5.4% Tuesday after the shale company, founded by billionaire Harold Hamm, disclosed that fourth-quarter spending was almost 10% higher than analyst expectations.

Wall Street support allowed shale companies to persevere through a plunge in oil prices that began in 2014, eventually helping the U.S. surpass Saudi Arabia and Russia as the world’s largest producer of oil , with 11.9 million barrels a day in November, according to the U.S. Energy Information Administration.

Banks have provided financing when producers spend more cash than they take in from operations, something that has happened every year since 2010. They also help companies hedge their future oil production to lock in prices and avoid market volatility, and provide them with revolving loans backed by future oil and natural-gas prospects.

But in 2016, federal regulators concerned about banks’ exposure to shale drillers tightened standards for lending to oil-and-gas companies after dozens went bankrupt amid the drop in commodity prices. The U.S. Treasury Department guidelines require lenders to regard loans as troubled if a company’s total debt reaches more than 3.5 times a producer’s earnings, excluding interest, taxes and other accounting items.

There is more to this article. You can find it by clicking on the link above. It appears that the shale celebration is finally slowing down. But those in the shale cheering section still far outnumber us naysayers.

We shall see.