The general trend in the global economy has been toward lower growth and productivity in the last half century. This trend is easily explained in biophysical economics as due to 1) increasing scarcity of finite resources due to depletion, itself the result of massive consumption in the modern age, and 2) erosion of carrying capacity due to many types of ecological damage from the era of massive consumption of natural resources. Conventional economists have nothing in their economic worldview to explain the trend, so they hide their failure with jargon words like ‘stagflation’ or ‘secular stagnation’, which don’t explain anything.

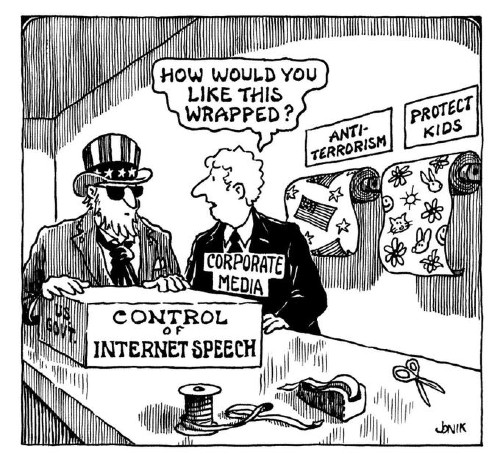

Faced with a trend, critical to the future of industrial society, that they cannot explain, economists have offered solutions that naturally don’t work, but appear to perpetuate growth by artificial means. A solid literature has developed to expose these solutions as illusory. This essay will summarize some of its conclusions, which may be particularly useful to those who may have been inclined to believe the illusions propagated by governments and the mass media.

Debt-based growth

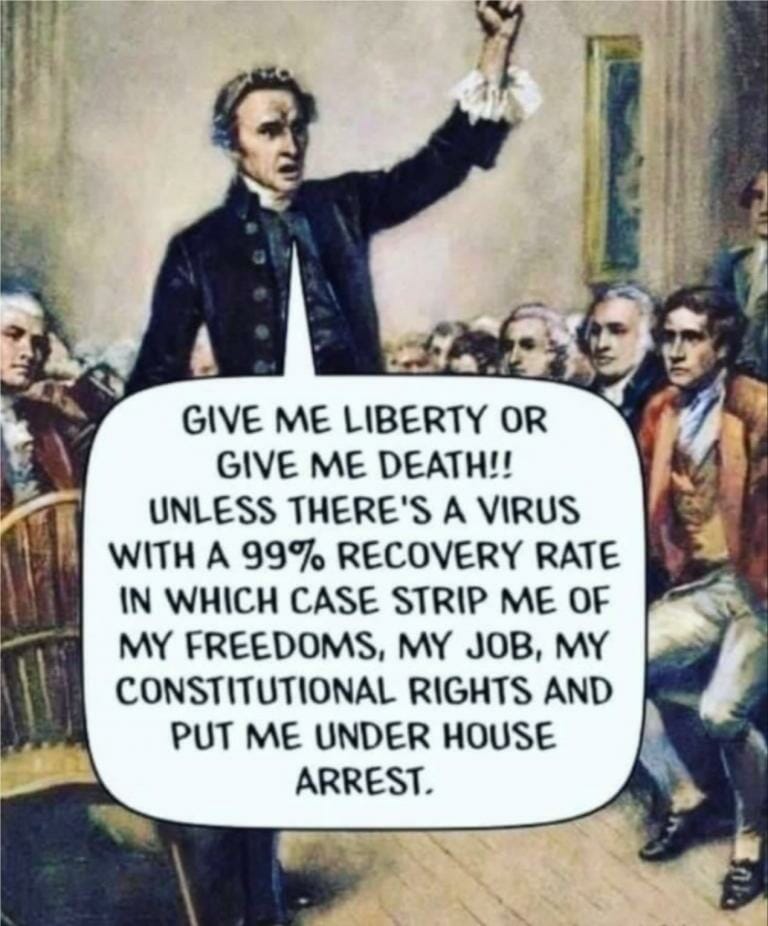

Money printing, hiding under labels like bailouts of too-big-to-fail central banks and quantitative easing, which started with the financial crisis of 2008 and accelerated recently as a policy response of a fabricated “pandemic”[1]. The policy response did habituate the public to house arrest under false pretenses and other violations of the Bill of Rights.

But money printing produced little growth in the US except briefly in economically nonviable enterprises like extraction of unconventional oil, or in the weapons economy where a decades-long fear campaign has sustained a bloated defense budget while driving the US government deeper into debt. Otherwise, the main effect has been to create dangerous bubbles in the rentier economy (an oxymoron), which consists primarily of the stock market, including speculative markets like currency and derivatives, and real estate. This process will continue until an inevitable crash brings about a new era of austerity.

Rigged statistics

Key government statistics like unemployment, inflation and gross domestic production (GDP) that mass media have taught the public to rely on as measures of the health of the economy have been defined in a way that deceives. This deception has been exposed in efforts like Shadowstats

That have revealed unemployment and inflation that is relevant to the prosperity of most people to be 2-5 times greater than in government statistics. GDP includes bubble “production” in the rentier economy and derivatives, none of which measure growth in real wealth. Thus, GDP is useful to the investor class but has misled the public as an assessment of most people’s standard of living despite how it is represented in the mass media and government. The success of rigged statistics is declining along with credibility in all mainstream institutions.

Energy alternatives

Along with many others, elsewhere[2] I have argued the impossibility of building energy alternatives to a scale that would support an industrial society. However, to summarize:

- The energy return on energy invested (EROEI) of alternatives is too low to sustain industrial economies.

- Even if it were possible to significantly replace fossil fuels with other energy sources, that would perpetuate the industrial economy and its resource depletion, eventually bringing down the industrial economy.

- The cost of conversion of the economy and infrastructure to new sources of energy itself entails sacrifices that 1) the global economy in its present decline can no longer afford, and 2) that already impoverished masses could not survive.

For now, the official narrative of endless growth continues to persuade most of the public that some sort of energy will be available to sustain industrial society. Different subnarratives are promoted according to political persuasion. Liberals have been induced see planetary overshoot mostly in terms of climate change, and so tend to support energy alternatives. Conservatives have been convinced to distrust government plans, and so tend to count on private enterprise to deliver more oil. Some Western transnational elites appear to understand the resource depletion problem, hence are promoting a “great reset” (see a discussion of this phenomenon below).

Technocratic solutions

“Great reset” narratives reveal that transnational capital and national ruling elites realize the implications of degrowth. Hence, they are planning degrowth for us that preserves growth and prosperity for them. These narratives hide technocratic totalitarian degrowth plans behind propaganda that promotes the ‘reset’ as green and socially just. So far, this propaganda is aimed at political liberals who have tended to accept the totalitarian aspects as a necessary ‘war economy’. Conservatives, suspicious of anything promoted as liberal, are actually more sensitive to the ‘big government’/fascist nature of elite plans.

Conclusion

At this juncture, some stories of the official narrative are becoming increasingly discredited in some quarters of society, while the delusions are holding well in others. And original delusions are often replaced by equally illusory subnarratives. It should be remembered that the core narrative that veils the concentration of wealth and power in a transnational financial elite has penetrated Western culture for over a century, passed down from one generation to the next, and is therefore deeply embedded. At this point it is therefore an open question when the dominant social order will crumble, and what will replace it.

[1] https://www.unz.com/proberts/how-the-covid-pandemic-was-orchestrated/

[2] Energy and Sustainability in Late Modern Society (http://karlnorth.com/?p=1244)

Author

Karl North has been a student, a farmer, a business owner, and a teacher. As a student, his strongest focus for over 50 years has been systems ecology and political economy (the power relations in social systems).

![]() Don't forget to feed the birds. Donate here

Don't forget to feed the birds. Donate here