Analyst and financial writer John Rubino says we’re are in a “debt and death spiral” that will force dramatic changes on the world. Rubino explains,

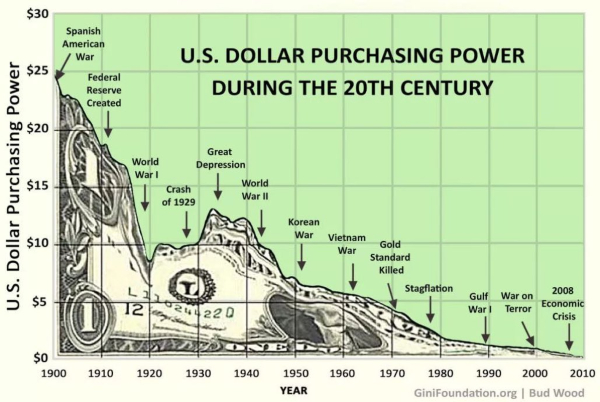

“The debt spiral part of this means things from here continue to get worse and worse for the big currencies of the world until they die. In other words, until people lose faith in them, refuse to use them and hold them anymore until their value falls to their intrinsic value, which is zero. That manifests to hyperinflation. The value of the currency falls as opposed to the things you buy with it. . . . Things feel basically okay for a long time as long as governments could force interest rates down to really low levels. The side effects of that are massive money creation and, eventually, inflation. That’s what we are dealing with now. So, here we go. Welcome to the end game for the world’s big currencies.”

Rubino contends things have gotten so out of control that there is no stopping what is coming. Rubino says,

“We are in the part of the cycle now where things just get worse, and there is nothing we can do about it. You are going to see companies that have borrowed huge amounts of money to buy back their stock, and now they see their interest costs explode. Governments around the world have the same problem, and there is nothing central banks can do about this. The next stage of this is when everybody realizes that there is no fix. Daddy is not going to come home and take care of all of this, and there is no adult supervision. The financial markets are basically on their own with so much debt that there is nothing left to do. You either have mass bankruptcies or inflate away the currencies of the world, and we’re there—finally. 2023 is going to be an amazing year . . . and we make the decision about what kind of a crisis we fall into. We have a 1930’s style deflationary depression, which is what happens if we keep raising interest rates. Or, a Weimar Germany kind of hyperinflation, which is what happens if we try to inflate our way out of our current debt problems. And that’s it. This is not something on the distant horizon anymore. It’s something right here staring us in the face.”

Rubino talks about the threat of global nuclear war and contends our extreme financial problems will seem timid if the nukes fly. In the nuclear war scenario, the global population could get cut in half with “radiation and starvation.” Rubino also talks about ways to be more resilient, and that starts with shedding as much debt as you can. It also includes food, water, cash, defensive investments and precious metals.

Rubino thinks the economy is so weak, with so many different financial bubbles, that one bubble pop could bring the entire system down rapidly. Rubino says look out for big European banks to go insolvent as a warning sign of trouble if the trillion-dollar derivative complex blows up.

There is much more in the 52-minute interview.

Join Greg Hunter as he goes One-on-One with financial writer John Rubino and his new enterprise called Rubino.Substack.com for 2.11.23.